Building Multi-Agent AI Systems: The LangGraph Architecture Behind Navam Invest

Single AI agents are impressive. But multi-agent systems? They’re transformative. When specialized AI agents collaborate, they can tackle problems that no single agent could solve alone. This is the architecture powering Navam Invest—and in this post, we’ll show you exactly how it works.

Why Multi-Agent Systems?

Investment analysis is inherently multi-dimensional. A single AI trying to do everything becomes a “jack of all trades, master of none.” Consider what’s needed for comprehensive investment advice:

- Fundamental analysis (financial statements, valuation models)

- Technical momentum (price trends, volume patterns)

- Macroeconomic context (interest rates, sector rotation)

- Risk management (portfolio exposure, VAR calculations)

- Tax optimization (loss harvesting, wash sales)

- Options strategies (hedging, yield enhancement)

- News monitoring (earnings, SEC filings, material events)

Each domain requires deep expertise, specialized tools, and different reasoning patterns. This is where multi-agent architecture shines: each agent becomes an expert in one domain, then agents collaborate to deliver comprehensive insights.

Enter LangGraph: Orchestrating AI Agents

LangGraph is a low-level orchestration framework for building stateful, battle-tested AI agent systems. Think of it as the “nervous system” for multi-agent intelligence.

Core Concepts

State Graphs: Workflows represented as graphs where nodes are agents or functions, and edges define how control flows between them.

Stateful Execution: Unlike stateless API calls, LangGraph maintains state throughout complex workflows, enabling agents to build on each other’s work.

Persistence & Checkpointing: Long-running workflows can be paused, resumed, and recovered—critical for reliability.

Human-in-the-Loop: Workflows can pause for human approval at critical decision points.

The Navam Invest Agent Roster

Navam Invest employs 10 specialized agents, each with distinct capabilities:

1. Quill: The Equity Analyst

Specialty: Deep fundamental research

Tools:

- Financial statement analysis (10-K, 10-Q parsing)

- DCF valuation models

- Comparable company analysis

- Investment thesis generation

When to use: “What’s the fair value of Apple?” or “Should I invest in Tesla?“

2. Earnings Whisperer

Specialty: Earnings surprise and momentum analysis

Tools:

- Earnings calendar tracking

- Transcript analysis

- Post-earnings drift detection

- Surprise impact assessment

When to use: “Which stocks have beaten earnings estimates this quarter?“

3. Screen Forge

Specialty: Systematic stock screening

Tools:

- Quality factor analysis

- Momentum screening

- Value metrics

- Thematic filters

When to use: “Find undervalued growth stocks in technology”

4. Macro Lens

Specialty: Top-down economic analysis

Tools:

- Economic indicator tracking

- Sector rotation models

- Market regime detection

- Factor exposure analysis

When to use: “How should I position my portfolio given current macro conditions?“

5. News Sentry

Specialty: Real-time event monitoring

Tools:

- SEC filing alerts

- News aggregation and filtering

- Analyst action tracking

- Volume anomaly detection

When to use: “Alert me to material events for my portfolio holdings”

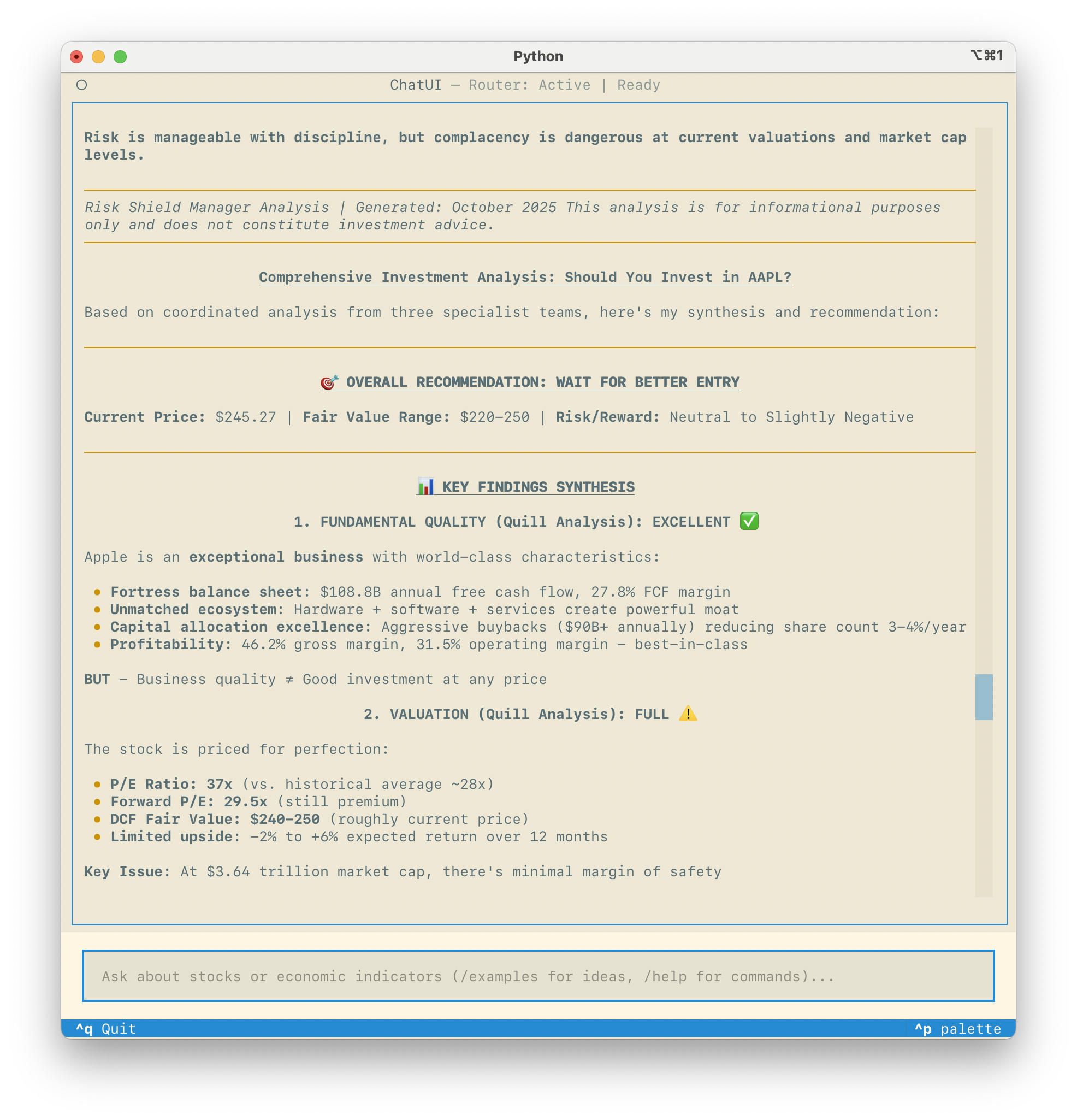

6. Risk Shield

Specialty: Portfolio risk management

Tools:

- Value-at-Risk calculations

- Drawdown analysis

- Scenario testing

- Concentration risk monitoring

When to use: “What’s my downside exposure in a market correction?“

7. Tax Scout

Specialty: Tax optimization

Tools:

- Tax-loss harvesting identification

- Wash-sale rule checking

- Lot selection optimization

- Capital gains planning

When to use: “What tax-loss harvesting opportunities do I have?“

8. Hedge Smith

Specialty: Options strategies

Tools:

- Protective collar design

- Covered call analysis

- Put spread strategies

- Cost-benefit modeling

When to use: “How can I hedge my tech position?”

Multi-Agent Workflows

The real power emerges when agents collaborate. Navam Invest includes pre-built workflows:

/analyze Command

A comprehensive 5-agent workflow that combines:

- Quill performs fundamental analysis

- Screen Forge checks momentum factors

- Risk Shield assesses risk exposures

- Macro Lens provides market context

- News Sentry surfaces recent events

Result: Institutional-grade analysis in 2-3 minutes

/discover Command

Systematic idea generation combining:

- Screen Forge identifies high-quality candidates

- Earnings Whisperer filters for positive momentum

- Risk Shield eliminates high-risk names

- Quill performs deep dives on finalists

Result: Curated list of investment opportunities

LangGraph Implementation Patterns

Pattern 1: Sequential Workflow

Agents execute in order, each building on previous results:

User Query → Agent 1 → Agent 2 → Agent 3 → Final ResponseUse case: Multi-step analysis where each stage depends on the previous one

Pattern 2: Parallel Execution

Multiple agents work simultaneously, results are aggregated:

User Query → [Agent 1, Agent 2, Agent 3] → Aggregator → ResponseUse case: Independent analyses that can run in parallel (faster execution)

Pattern 3: Conditional Routing

Router agent decides which specialist to engage:

User Query → Router → [Agent A OR Agent B OR Agent C] → ResponseUse case: Query classification and intelligent routing

Pattern 4: Iterative Refinement

Agent output loops back for improvement until quality threshold met:

User Query → Agent → Validator → [Pass → Response | Fail → Agent]Use case: Ensuring output quality meets standards

State Management

LangGraph’s stateful execution enables sophisticated workflows:

# State accumulates as workflow progresses

class InvestmentState(TypedDict):

query: str

fundamentals: dict

technicals: dict

risks: dict

macro_context: dict

final_recommendation: strEach agent adds its findings to shared state, building comprehensive analysis.

Error Handling & Resilience

Production systems need robust error handling:

- Retry Logic: Automatic retries for transient failures

- Fallback Agents: Alternative paths if primary agent fails

- Checkpointing: Save progress at workflow milestones

- Timeouts: Prevent runaway executions

Performance Considerations

Token Optimization

- Minimal prompts reduce token usage

- Shared context prevents redundant API calls

- Strategic caching for frequently accessed data

Parallel Execution

Run independent agents simultaneously to reduce latency:

- 5 sequential agents: ~5 minutes

- 5 parallel agents: ~1 minute

Progressive Streaming

Show incremental results as agents complete rather than waiting for final output.

Key Takeaways

- Specialization Beats Generalization: Expert agents outperform jack-of-all-trades models

- State Management is Critical: Shared state enables agents to build on each other’s work

- LangGraph Provides Production Infrastructure: Persistence, checkpointing, and error handling built-in

- Start Simple, Scale Up: Begin with one agent, validate, then add more

- Transparency Builds Trust: Show agent reasoning, not just final outputs

Getting Started with Multi-Agent Systems

Want to build your own? Here’s the path:

- Identify Domains: Break your problem into specialized sub-domains

- Design Agents: Define each agent’s role, tools, and expertise

- Map Workflows: Draw state graphs for how agents interact

- Implement with LangGraph: Start with simple sequential workflows

- Add Complexity Gradually: Parallel execution, conditional routing, iterations

See the Architecture in Production

Everything described in this article is live code you can explore and run. Navam Invest implements this exact LangGraph architecture with all 10 specialized agents working together:

Navam Invest

Multi-agent investment intelligence with streaming TUI. Production-grade test coverage and code metrics shown in real terminal output.

- 10 specialized AI agents with LangGraph orchestration

- 90%+ test coverage with detailed metrics

- Textual TUI framework with streaming responses

Conclusion

Multi-agent AI systems represent a paradigm shift in how we solve complex problems. By combining specialized expertise with intelligent orchestration, we can build systems that match or exceed human expert performance.

Navam Invest proves this approach works at real-world scale. Ten specialized agents, multiple collaborative workflows, all running on your laptop—delivering professional-grade investment intelligence.

The future of AI isn’t single super-models. It’s specialized agents working together, orchestrated by frameworks like LangGraph.